A good deal of odd and folk-lore design priors float around gaming; my two favorites are free hard currency and time-limited cosmetics predicated on FOMO or fear of missing out. The FOMO model suggests developers ought to stuff their game with time-limited content, once the timer is expired the content is gone forever (or for a long time – a year or more). I’ve argued paper-thin theory holds up free hard currency, but small revenue stakes drape it as a marginal issue, whereas the FOMO model has a far more significant impact on the bottom line. High-stakes decisions demand more substantial evidence than low-stakes decisions, and we don’t yet have one for the FOMO model beyond “Fortnite does it.” Is there a persuasive and substantial case for FOMO?

Consider two battle pass models: one in which pass content is never sold after its initial introduction and another where it’s always available for purchase; Fortnite provides a real-world example. In the four years since its introduction, Epic has launched 17 (!) battle passes. A given battle pass caps spending at $160 ($10 Pass + $150 on tiers), so multiplying the passes together results in a total spend Depth of $2,720 ($160*17). As Fortnite development marches on, total spend depth grows by a tune of ~$600 a year or by about four battle passes worth ($160*4).

The effective revenue from a given player is a function of spend depth against the likelihood of “filling” that spend. If a given player spends $40 on a battle pass, we might say they have 25% spend Fulfillment ($40/$160). The spend “fill” notion helps expand on our prior model of cosmetics and battle passes.

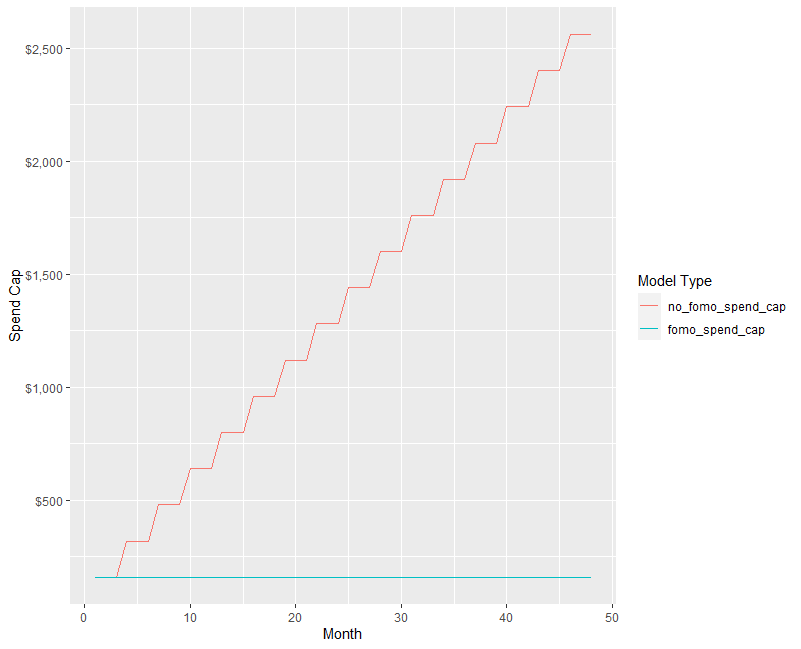

If we allow players to purchase a given battle pass at any time, rather than the three-month duration, they run for, spend Depth explodes. Not only does spend Depth explode, but it grows over time. In a time-limited world, spend Depth is always constant. It’s striking to visually examine how Fortnite’s spend depth would have grown had they offered older battle passes to purchase.

Fortnite Battle Pass Spend Cap Models

A player acquired to Fortnite a year after its launch faces $640 in total BP spend cap against only $160 in a FOMO model. At a constant spend fulfillment rate, say 25%, player LTV is wholly altered; $160 versus $60 in expected revenue ($640*.25 vs. $160*.25).

The standard objection to the no-FOMO model is that there are no constant returns to growing to spend Depth for a given player. Proponents of this argument claim there is an inverse relationship between spend fulfillment and spend Depth. Instead of spending Depth staying constant at, say, 25%, it declines for each $1 increase in spend depth.

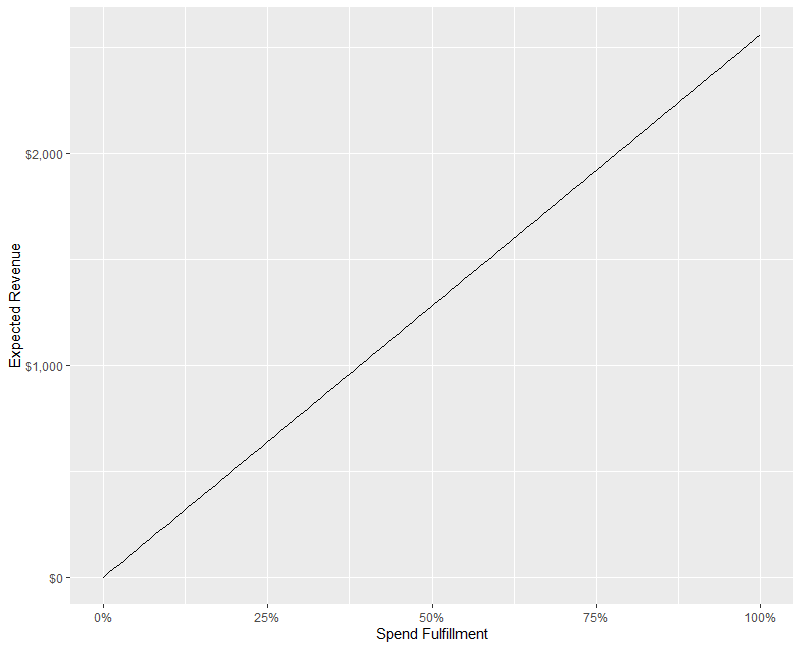

Diminishing returns to scale is an entirely reasonable objection to the model, but it’s not enough to falsify the no-FOMO model. The variable we care about maximizing, expected revenue, only declines when the rate of decline in spend fulfillment is greater than the rate of increase in total spend cap. To visually illustrate, we can model the change in expected revenue with changes in spend fulfillment.

Fortnite Spend Fufillment Against Expected Revenue

At 100% spend fulfillment, a player purchasing all 17 battle passes and tiers rings in expected revenue of $2,720. A player needs only 5.8% spend fulfillment against this total to produce $160 in expected revenue – the total possible spend under 100% spend fulfillment in the FOMO model.

Yes, the no-FOMO model may produce lower spend fulfillment, but it’s tough to imagine the rates of decrease outpacing the increases in spend depth and thus expected revenue. Imagine if HBO decided that Game of Thrones would only be available during certain weeks rather than on-demand. Overall conversion would spike during the period, but it’s obvious that’s not the revenue-maximizing solution for the content. We could certainly debate the viability of time-limited discounts or loss-leader items to drive traffic, but what the game industry is doing is paramount to book-burning: pillaging hundred of pieces of content every three months.

The Acutally Missing Out Objection

The second objection to the FOMO model is time-fixed effects. During any BP three-month period, there could be, say, 1M unique players. But fast forward a year, and a new three-month BP period may see 2M new unique players. The FOMO model doesn’t expose new players to the prior pass content, and thus they never had the opportunity to spend on it. Sorry, you never got to see Star Wars, kid, but we’ve burned all the copies.

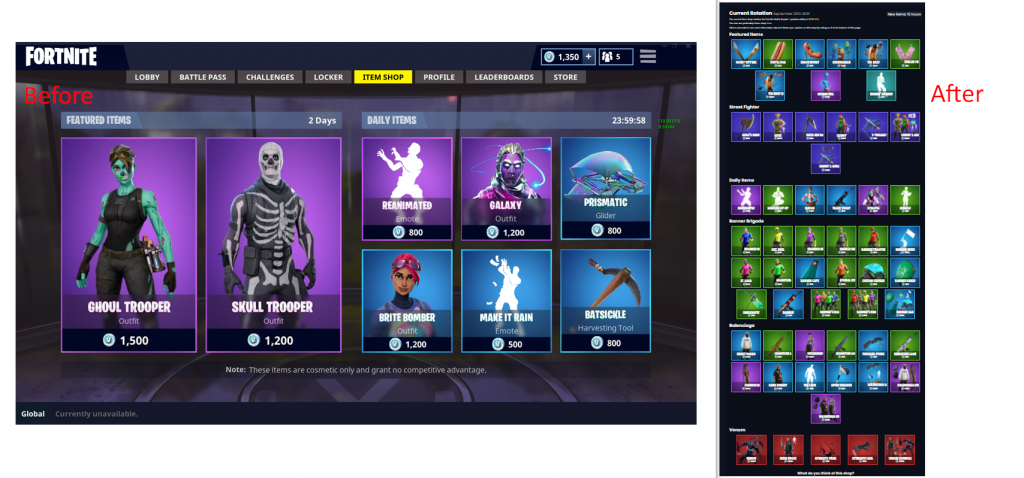

At the very least, Fornite and Call of Duty Warzone have moved to higher item carry in their rotating stores. What was once a quaint eight items has exploded to some ~50 items.

Fortnite’s Growing Store

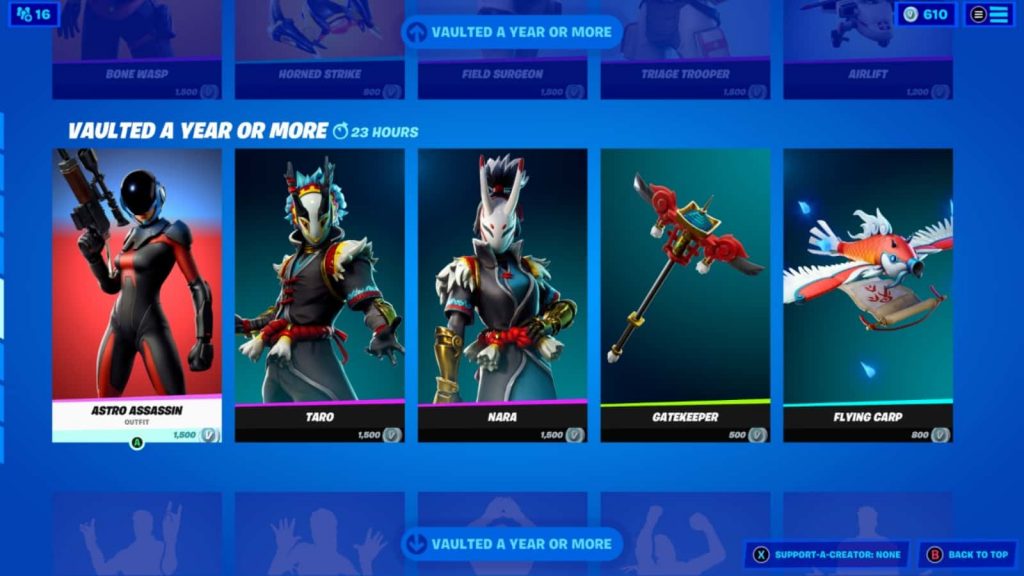

We’ve also seen the introduction of a vault to bring back old content.

Miss Me? Returning Cosmetic Content

Gaming firms are learning. In addition to Fortnite and Call of Duty Warzone, Valorant leans into the same concepts. Of course, Valve figured all this out years ago with limited selections of FOMO content backed by an auction house. The case for FOMO has never been strong and only weakens larger an audience is for a given title.