Will Luton argues on the dangers and solutions to F2P inflation over at gameindustry.biz.

While there are some missteps in the opening of the article, Will makes a powerful and elegant point:

…a sale can only be considered profitable if the net revenue from the start of the sale until resource equilibrium, and so demand, is restored is more than if the sale hadn’t been run. For well run sales in games with well balanced economies this should always be true.

Sales flood the economy with resources via shifts along the demand curve. Holding all else equal, this is modeled as a move from P1 to P2.

The tricky part, not found in the textbook model, is time. Unlike say, refrigerators, a durable good, virtual currency is a consumable good. This means we expect repeat purchases, similar to say, gasoline. Sales in this sense pull revenue forward by changing purchase ‘schedules’ more so then a durable good. The sales are only profitable if the sale sinks resources players would have never sunk otherwise (net positive sink). In games, this is achieved this achieved via live ops. This model explains how Supercell runs their games; it’s no coincidence that Clash Royal is the first Supercell game to have sales and real live ops while their other titles have little of either. Introducing one without the other keeps net sink flat in the long run by shifting intertemporal time preferences rather than increasing the size of the ‘sink pie’ so to speak.

Progression is another confounding variable. Holding all else constant, a given item is worth less for each additional level a user is at. This is simply an artifact of rising difficulty (in the form of stronger enemies, more experience to level up etc). As a result, sales make late game players in different while making early game players better off.

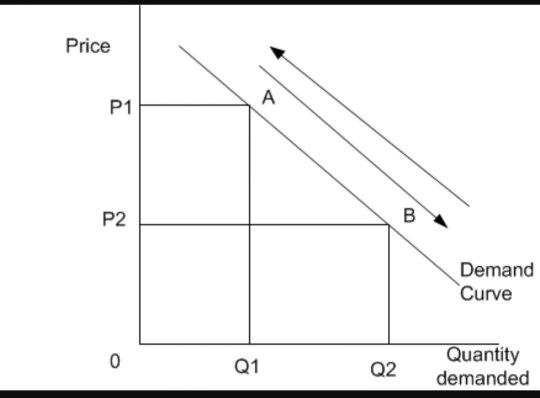

Reproduced from the original article. Left: player progression on a game with without sales. Right: a game with sales.

The insight Will offers is that sometimes this is an advantage by changing the progression path of newer players to a higher equilibrium then current late game players previously had. This allows new players to ‘catch-up’. This sounds a lot like the Solow model. Yes, that Solow model 1. I don’t think Will models this correctly, however, as each player is not on a discrete curve as his graph on the left depicts. Even without inflation, the graph on the right is an accurate picture of a given game economy.

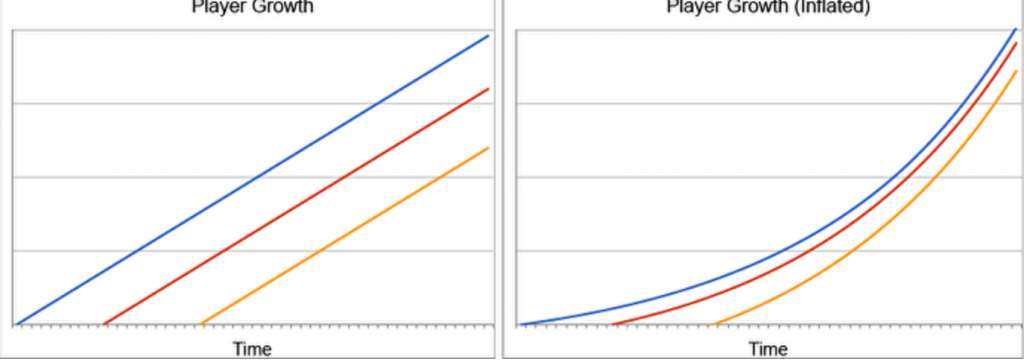

Consider two possible goods that could be put on sale (and thus inflated) from Clash of Clans: a builder or gold. The builder is a dramatically better purchase because it allows for more output per unit of gold or elixir (increase in technology). This shifts the growth rate of a given player up. On the other hand, the gold is a small one-time increase in capital stock that won’t scale with the game. For designers, this offers the chance to use sales as strategic instruments to alter the metagame. By offering Clash of Clan players discounts on a builder, players converge and then exceed the GDP of elder players. A sale of gold, however, merely ‘jumps’ the GDP of players without changing the long-run growth rate. This means designers can either jump the point along which new players are on the progression curve or they alter the new player curve entirely.

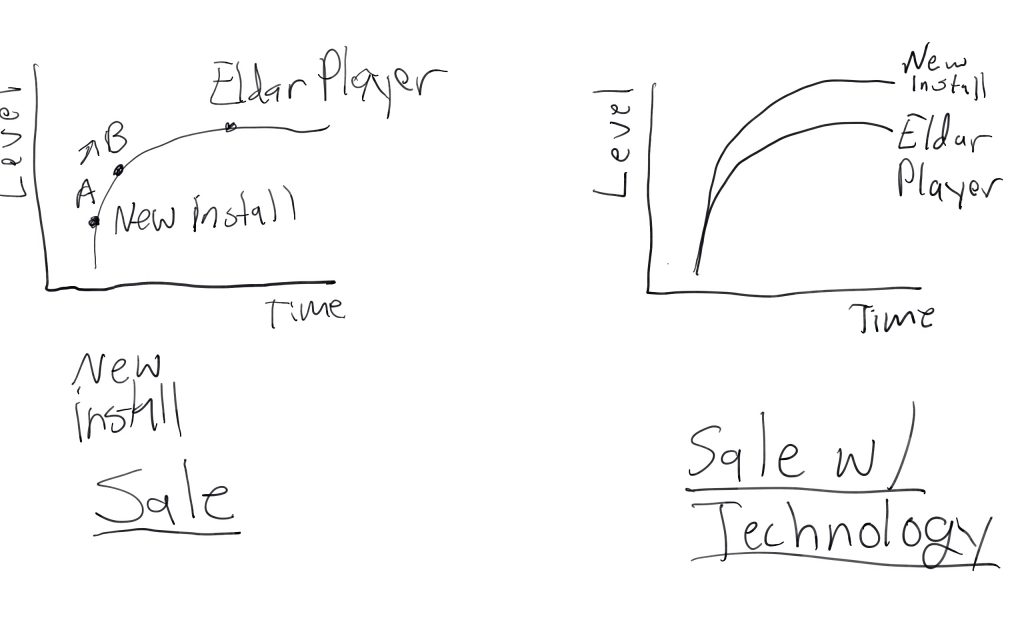

Sales jump players along the curve (A -> B), while a sale with ‘technology’ creates an entirely new curve. Also, I have an S pen. Watch out art team.

Back again

Known as ‘Destroyer of Toy Islands’ on Server 54G, Robert Lucas knows no mercy.

Unfortunately, this can deter some investment by changing inflation expectations. If players know a given dollar will have increased purchasing power later on, why make the investment now? Indeed, a 30+ paper written by Game of War players and subsequent boycotts attest to the negative side effects of perpetually trying to catch players up.

Careful consideration and analysis can make sales a valuable gameplay tool as much as they are a business one.

- Solow, Robert M. (February 1956). “A contribution to the theory of economic growth”. Quarterly Journal of Economics. Oxford Journals.70 (1): 65–94. doi:10.2307/1884513. JSTOR 1884513. Pdf.